LA Fire insurance loss estimate has topped $25 billion,according to Autonomous reinsurance consultants. As a resultof California Fair Plan insolvency, every insured homeowner is now on the hook for about $5,200 in surcharges to pay for LA Fires.

Autonomous Research increased their insured loss estimate for the ongoing Los Angeles wildfires by 92% to $25 billion. The new forecast means that California’s FAIR Plan insurer of last resort will suffer $8 billion loss, with only $3 billion to pay claims.

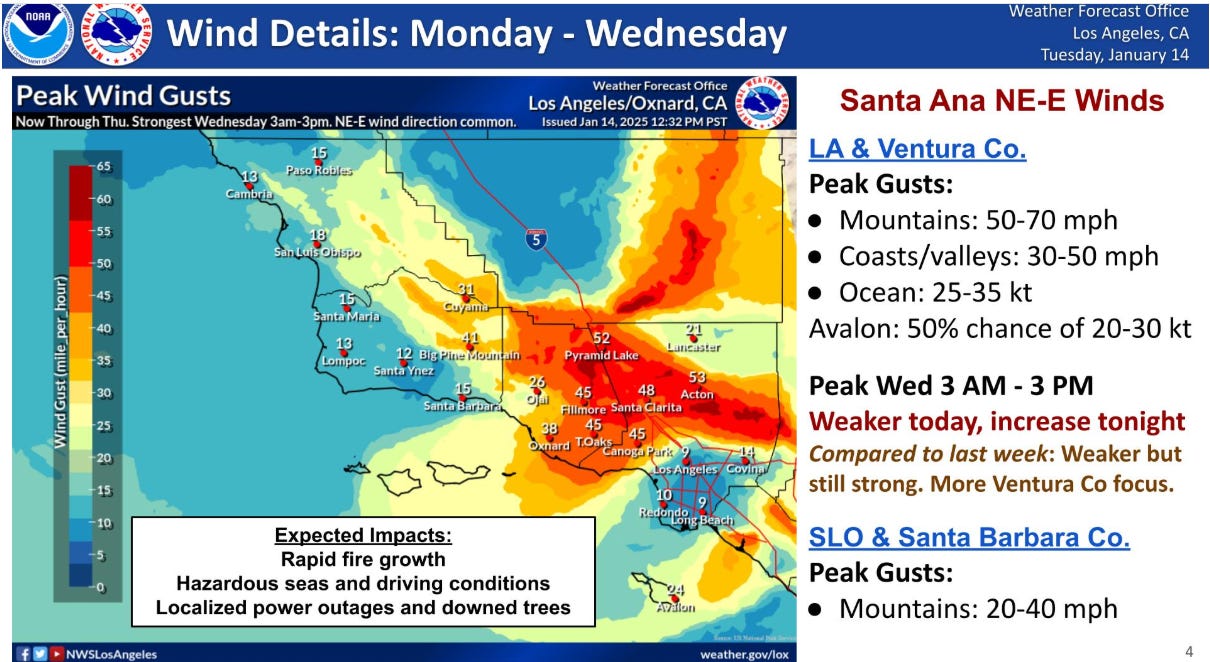

The Los Angeles fires as of Tuesday afternoon had officially burned over 40,000 acres, killed at least 26 people, and caused more than 12,000 structures to be reported as either damaged or destroyed. Losses will rise with 30-60 mph Santa Ana winds forecast through January 16th.

Autonomous Research provides claims analysis models for the global reinsurance industry, estimates reinsurance risk ranges from less than 10% in low-risk regions, to as much as 40% in high-risk coastal areas where the most catastrophic losses are located.

Based on loss data from January 14th, insured losses of $18 billion are [projected for the affluent Pacific Palisades neighborhood that suffered 5,000 damaged or destroyed structures. Insured losses of another $4.5 billion are estimated for the Eaton, Hurst and other, smaller blazes in parts of LA.

Autonomous models predict another $2.5 billion of additional commercial exposures are at risk in LA County, which is over twice the approximately $1 billion of commercial losses associated with the 2023 Maui wildfires.

The combined commercial and residential loss risk of $25 billion could result in the attachment of per-occurrence reinsurance coverages.

Of the $25 billion insured losses, “Autonomous expects as much as $8 billion to fall to the California FAIR Plan, which at that scale, faces potential insolvency.”

The California’s FAIR Plan is estimated to have about $24bn ofinsured exposure in the areas affected by the Los Angeles County wildfires, with $6bn of exposure to the Palisades fire alone.

The FAIR Plan as the state’s insurer of last resort, typically only covers basic property damage and caps residential policies at a $3 million limit, and $20 million per commercial location.

“Overall, we point to $8bn of potential FAIR Plan losses — or 25% of total exposures — as a starting point for the state’s share of the wildfire loss. With a potential loss of that size, questions of FAIR’s insolvency remain front of mind, and private insurers potentially face a large bill should the FAIR Plan be unable to cover its claims obligations. Testimony given by the FAIR Plan to state lawmakers last year indicates the Plan has $2.5bn of reinsurance coverage in addition to ~$700mm of cash on hand,” according to Autonomous analysts.

The FAIR Plan has about $200 million in reserves and did purchase about $2.5 billion of reinsurance coverage to help stabilize the California market by transferring some of the risk, and avoid insolvency and cause pro rata assessments to all insurers. Those assessments will flow through to residential and commercial insureds as surcharges.

The cause of the fires officially remains unknown, but investigators in Altadena are looking into whether an electrical transmission tower could have caused the Eton Fire. If a California a utilities company were found to be liable, the State of California could access the state has a utility wildfire insurance fund that could pay up to $15 billion.