Silvergate Bank in late 2021 was the global leading crypto-currency bank with $14.3 billion in deposits, and a $7 billion stock market valuation after its stock rose by 1,580% in two years. But after an epic run-on-the-crypto-bank, the once high-flyer filed for a Chater 7 liquidation that wiped-out all equity value.

Founded as a one-branch La Jolla based savings and Loan Association in 1988, Silvergate grew slowly to 3 branchesand converted to a community bank in 1996. The bank’s CEO Alan Lane personally investing in Bitcoin in 2013, then three years later launched Silvergate Exchange Network” as a real-time payments platform that seamlessly converted crypto transactions into dollars and euros. The pioneering bankwithin a year had 250 large crypto customers and $1.9 billion in assets.

One of those customers was Alameda Research, run by twenty-six-year-old former Wall Street trader named Sam Bankman-Fried (knick-named SBF). Alameda quickly grew to become one of the most active crypto exchanges, partly due to its early embrace of Silvergate Exchange Network. SBF leveraged his international connections with London, Hong Kong, Amsterdam, and Singapore to launch a Bahama-based offshore crypto exchange called FTX, that also usedSilvergate to process wire transfers in multiple currencies.

Silvergate by trumpeting itself as the first regulated bank to clear crypto payments, was able to go public in late 2019 at price of $13 dollars a share, for a market value of $35 million. The company aggressively advertised its unique business model in 2021 as “You’re Innovative And So Are We.” Silvergate deposits from its 1,677 “Silvergate Exchange Network”, including every major crypto exchangeand over 1,000 institutional investors, vaulted to $11.7 billion. Because 82 percent of Silvergate Bank’s deposits were related to crypto, its Silvergate stock by late 2021 had rocketed up by 1,580% to $220 a share, commanding a total market value of $14.3 billion.

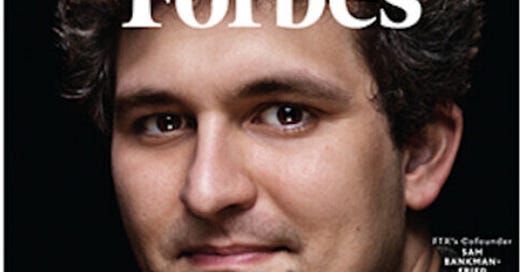

Sam Bankman-Fried was prestigiously featured on the cover of Forbes Magazine at age 30 as one of the richest 400 Americans. SBF claimed his goal was to create a better world by contributing more than $70 million to mostly Democratic incumbents and leftist PACs during the 18-month runup to the 2022 midterm-elections. SBF was second only to George Soros as the Democrats largest contributor, according to the Center for Responsive Politics.

The crypto world was jolted in May 2022, when supposedly “stablecoin” UST that was issued by Do Kwon’s Terra, turned out to be a Ponzi scheme. Over the next six months with crypto currencies falling in value, a string of companies that had provided margin lending against crypto deposits failed including Voyager, Celsius, and BlockFi. “Proprietary trading” firm Three Arrows Capital also collapsed after the founders luted investor deposits.

But Sam Bankman-Fried’s big political bet seemed to have paid off “big-time” on November 8, 2022, when the Democrat Party held their US Senate majority and scored new tri-fecta control of the governor and both state legislature houses in Michigan, Minnesota, Maryland and Massachusetts. SBF’s face was plastered across network TV screens as proof that nouveau riche tech progressives moving into sustained political power. But the next day, FTX’s merger failed and the company facing a liquidity squeeze filed for bankruptcy on November 11.

The ensuing panic collapsed crypto asset prices and hammered the liquidity of crypto exchanges. Silvergate Bank suffered significant decline in its assets as non-interest-bearing deposits fell to $7.4 billion in December 2022. The financial contagion caused interest rates to spike higher, resulting in mass selling of treasury bonds, US agency securities, and municipal bonds. Silvergate was forced to liquidate its substantial long-term Treasuries for a net loss $948 million for fiscal year 2022.

It was soon revealed that Sam Bankman-Fried had deliberately co-mingled FTX and Alameda Research assets. Refusing to testify at a US Congressional investigation, SBF was arrested in the Bahamas on an Interpol warrant on January 26, 2023over allegations that SBF, FTX and Alameda had committed crimes including: campaign finance violations and potentially bribing Chinese officials. Although Silvergate claimed no knowledge, Massachusetts Senator and Banking Committeemember, Elizabeth Warren wrote two letters alleging Silvergate CEO Alan Lane may have had criminal liability regarding the bank’s FTX and Alameda transactions.

The Federal Reserve, FDIC (Federal Deposit Insurance Corporation), and Office of the Comptroller of Currency issued a joint statement warning banks that serviced crypto customers could be at risk of failure. Silvergate Bank’scollapsing stock price finished 2022 at price of $16 a share. Having lost over 80 percent of its assets and at risk of an FDIC takeover if the bank did not get crypto associated accounts below 15 percent, Silvergate Bank announced a voluntary liquidation on March 8, 2023.

The 2023 United States Banking crisis resulted in the largest one-year regulated bank combined asset losses of $548.7 billion, including: Silicon Valley Bank, First Republic Bank, Signature Bank, Silvergate Bank, and Heartland Tri-State Bank. The official FDIC explanation for 2023 bank losses were due to increases in mortgage rates, with 30-year fixed-rate national average jumping 209 basis points since the first quarter of 2022.

Despite the Silvergate liquidation resulting in no bank depositor or FDIC losses, the crypto-friendly bank did start the 2022-23 national bank-run. To send a message to other banks to avoid such creativity in the future, Silvergate Bank was forced to sign a $63 million consent order with the California Department of Financial Protection and Innovation, a parallel consent order and $43 million Board of Governors of the Federal Reserve System fine, and U.S. Securities & Exchange Commission penalty assessments of $50 million. Silvergate Bank shareholders that once had a market value of $7 billion,have been wiped out.