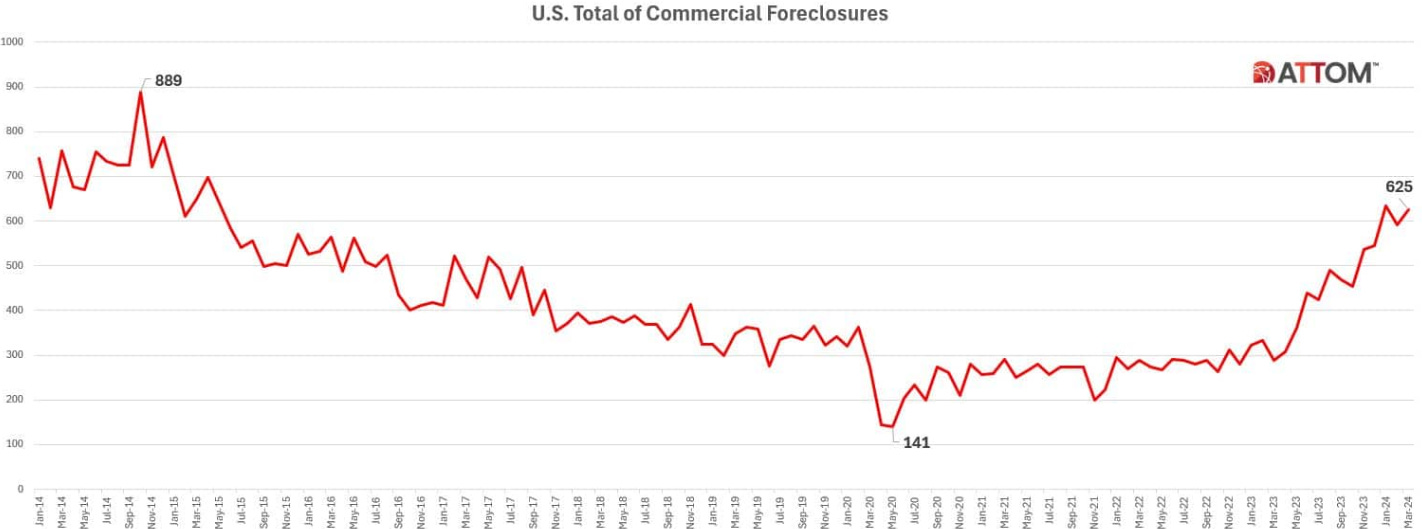

Commercial Real Estate Foreclosures Growing at Record Pace

Commercial Real Estate foreclosures are rising at the steepest rate in history and now at the highest levels since 2015 according to ATTOM data analytics. CRE foreclosures topped 625 in March, up 6% from February and 117% from the same period last year.

The rise in foreclosures has been led by California, which hit a record “100 cases and are continuing to escalate thereafter”, according to ATTOM. Other states with the worst foreclosure performance are New York, Florida, Texas, and New Jersey that suffered substantial increases in CRE foreclosures last month.

During the 2009-2010 Great Financial Recession, the US Congress passed and President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act. The legislation blamed big banks for causing the recession, although it was federal housing policy that enforced the requirement for big banks to make increasing amounts of sub-prime loans to minorities and first-time homeowners.

As a result, big banks defined as over $100 billion in assets, were required to drastically reduce commercial real estate lending. Historically, big banks took 35% collateral down-payments and higher interest rates to offset the variability of office tower vacancies. This risky business made good sense for big banks that had the big balance sheets to set aside huge amounts of cash to absorb huge losses in down cycles.

But since 2011, US regional and small banks essentially took over most of this risky business. Today more than half of all commercial real estate loans are held by the 4,600 in the US small and regional banks with less than $50 billion in assets, according to Risk Quantum analysis of bank regulatory filings.

This proportion of lending focus has remained steady despite the US Federal Reserve’s interest-rate tightening cycle that began two years ago. As a result, small and regional banks at the end of 2023 had over $1.68 trillion of outstanding commercial real estate loans.

Last month, US Federal Reserve Chair Jerome Powell testified on Capitol Hill, “We have identified the banks that have high commercial real estate concentrations, particularly office and retail and other ones that have been affected a lot.” Chairman Powell added, "This is a problem that we’ll be working on for years more, I'm sure. There will be bank failures, but not the big banks.”

The US Treasury Department's Financial Stability Oversight Council recently warned that office vacancies have accelerated from less than 5% in 2018 to 13.1% at the end of 2023. The COVID-19 lock-downs convinced many corporations and their staff that they could work more effective from home or from small offices outside of metropolitan

Since President Trump’s last year in office in 2021, the US Office Years of Supply for class A buildings has risen from 13-18 years. Even more ominous, the US Office Years of Supply for class B & C buildings has risen from 18-23 years.

Morgan Stanley warned earlier this year that office prices could plunge 30% due to sliding demand. Given that prices through 2023 were already down by about 15%, that would mean that virtually the entire $1.68 trillion of outstanding commercial real estate loans are upside down. Morgan Stanley also warned that oversupply of downtown apartment vacancies is rising fast and they predict apartments foreclosures to be the next big down-leg of the commercial real estate crash.