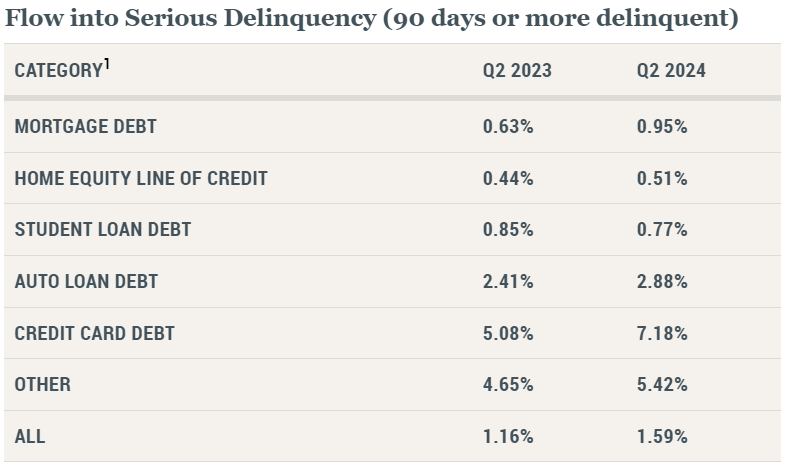

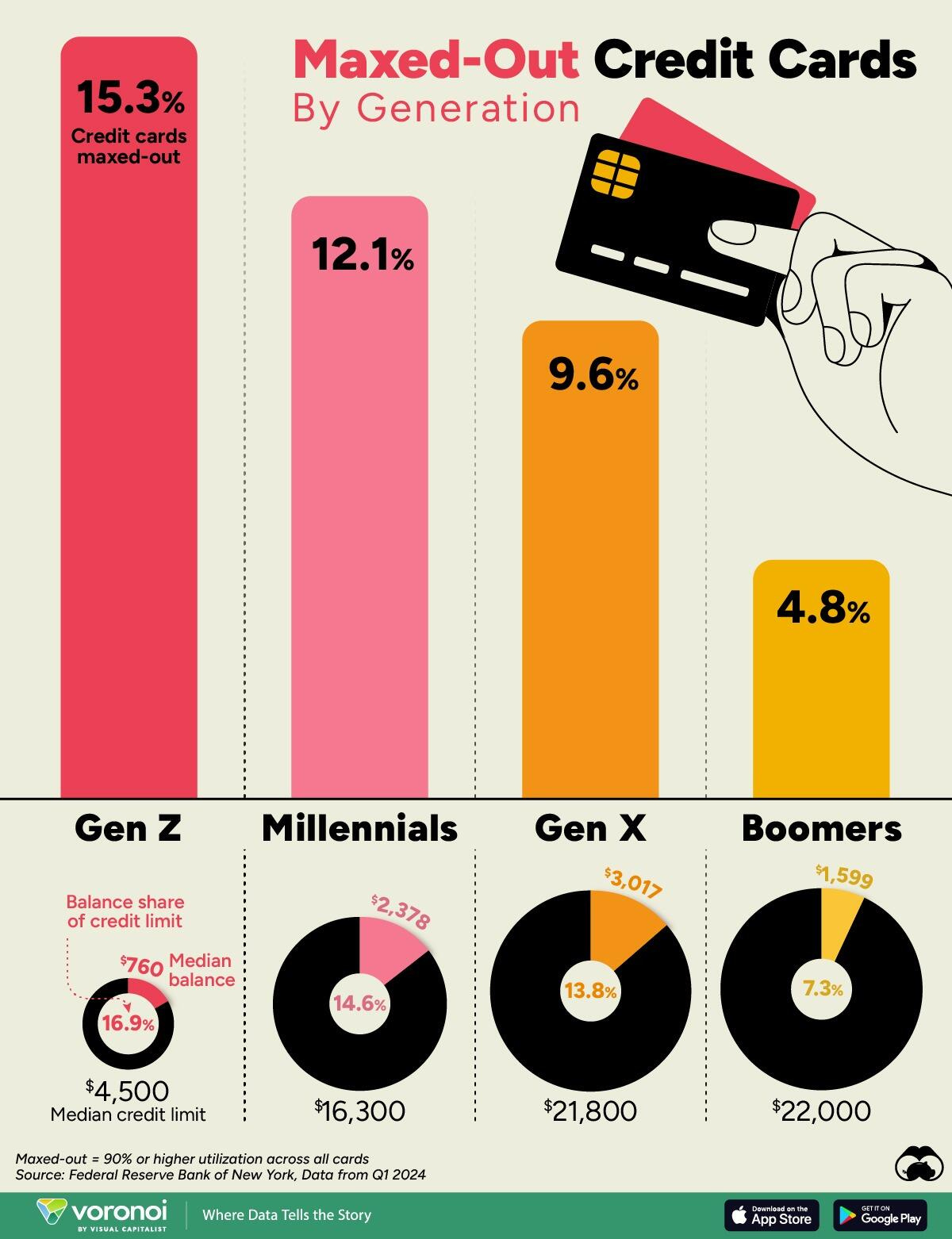

The Federal Reserve reported credit card payment delinquencies through June rose by 41.3 percent over the last year from 5.08percent to 7.18 percent. Furthermore, about 1 in 7 Generation Z and 1 in 8 Millennials are now maxed-out their credit cards.

Over the last year, approximately 9.1 percent of total credit card balances and 8.0 percent of total auto loan balances transitioned into delinquency status. Those numbers include the 136,000 Americans that had a bankruptcy notation added to their credit reports in the second quarter of 2024.

Normally the credit card utilization rate—percent of total credit limit being used—decline in the first half of the year as consumers pay down their balances, then grow in the second half of the year during summer and the year-end holidays. However, utilization rates have remained flat this year at about23 percent of credit card availability.

Available credit utilization rates differ substantially, with 52 percent of borrowers using less than 20 percent of their credit card availability; 19 percent using between 20 and 60 percent of credit card availability; 11 percent were between 60 and 90 percent; while 18 percent of credit card holders were defined as “maxed-out” for using at least 90 percent of their available credit.

Key factors for missing payments on credit cards range from absent mindedness to cash-flow constraints and income loss. The most correlated factor for future delinquencies is maxed-out credit cards, which is also the key input for credit scores that financial institutions use measure the probability of a future default.

The Visual Capitalist's Kayla Zhu demonstrates the share of U.S. adults that have maxed-out their credit cards at 90 percent by age group:

Delinquent borrowers are often renters that have shorter credit histories and lower credit limits, making them more financially vulnerable and missing a payment. With most credit cards having a variable rate, the interest rates on credit card balances jumped from 16 percent in 2022 to a near all-time high of 21 percent today.

As a result, an individual with a $6,000 credit card balance that makes the minimum payment per month, would pay over $9,500 in interest over the next 20 years to years to pay off their credit card debt.

The Federal Reserve on September 18th reduced interest rate it charges banks by .5 percent, but there was no indications that financial institutions will soon reduce credit card interest rates.