The International Monetary Fund annual assessment of the US economy warned Americans for the first time: “The fiscal deficit is too large, creating a sustained upward trajectory for the public debt to gross domestic product ratio.” The main culprit for the warning is the Biden-Harris Administration deficit spending during economic expansion has caused the long term-inflation trend to turn up for the first time since 1980s.

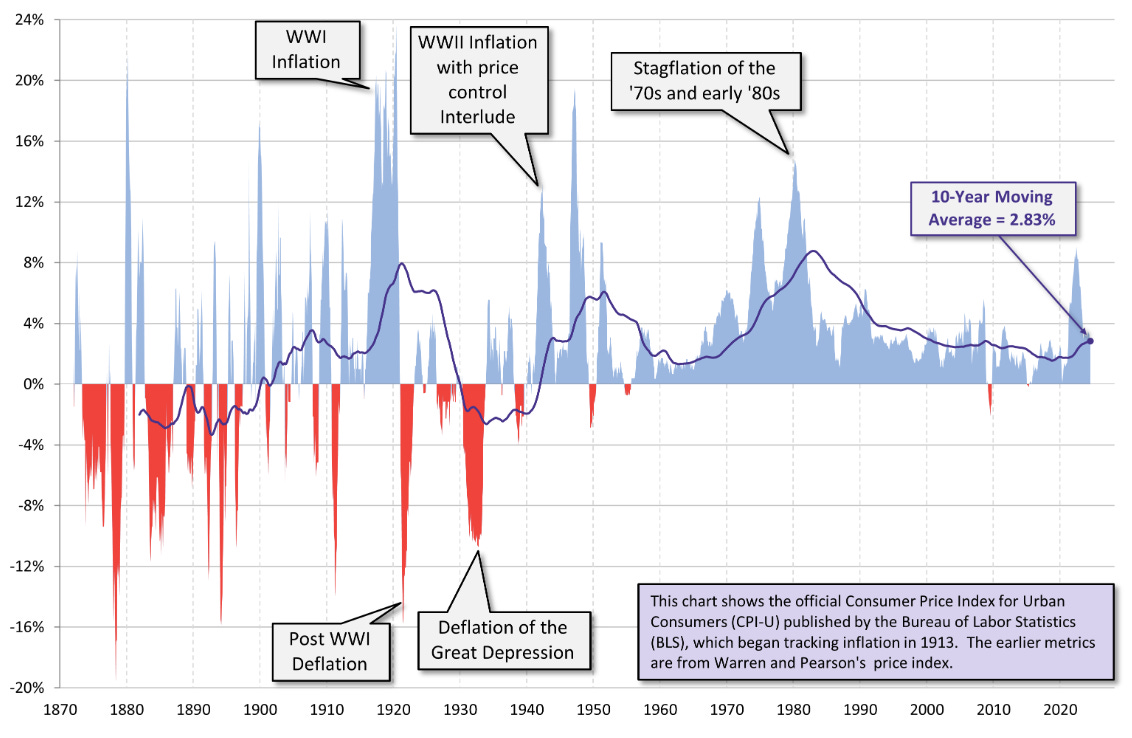

As the chart above demonstrates, the US adopted Keynesian Economics after World War II to avoid deflation by employing counter-cyclical fiscal policies. That is a fancy way to say the US government would increase deficit-spending as a percent of the economy when unemployment rises during recessions, and then cut government spending during economic expansions as unemployment shrinks.

But since the 2009-2010 Great Financial Crisis, deficit spending has actually increased rapidly during both economic recessions and economic expansions. As a result, the US debt tripled to $35.4 trillion and daily interest on the debt quadrupled to about$4 billion.

US Debt as percentage of GDP dramatically went up during the Obama-Biden Administration from 42 percent of GDP to 76 percent of GDP; went up slowly during the Trump-Pence Administration to about 80 percent; and then accelerated again during the Biden-Harris Administration to 100 percent of GDP. Biden-Harris Administration inflation also caused the average interest rate on the US debt to almost triple from 1.62 percent to 4.31 percent. At the current interest costs, US debt is projected to increase to 122 percent of GDP over the next ten years.

The Congressional Budget Office projects the annual average cost of US debt interest payments will fall from the current 4.3 percent to 3.5 percent over the next 10 years. At that interest rate, the annual US debt interest cost would be about 23 percent of tax revenues. But if the US average interest costs increases to 6 percent, the annual interest cost of the US debt would skyrocket to 45 percent of annual tax revenues.

Rising US government debt and the interest cost to service thatdebt is now officially considered a global financial risk. Either Congress comes to a consensus to cut spending, or there is a risk the US dollar could lose its supremacy as the world’s reserve currency.